In a Rush?

After removing my personal data from 47 broker sites last month, I checked back two weeks later. Twelve had already re-listed me.

This wasn't a fluke or technical error. It's the dirty secret of the data broker industry: removal requests are treated as temporary inconveniences, not permanent deletions.

According to privacy research firm DataGuidance, 73% of data brokers re-add consumer information within 90 days of removal requests. The average re-listing time? Just 23 days.

Why Data Brokers Keep Re-Adding Your Information

Data brokers operate like digital vacuum cleaners, constantly sucking up personal information from hundreds of sources. When you opt out, you're essentially asking them to ignore one specific pile of data while leaving all their collection mechanisms running.

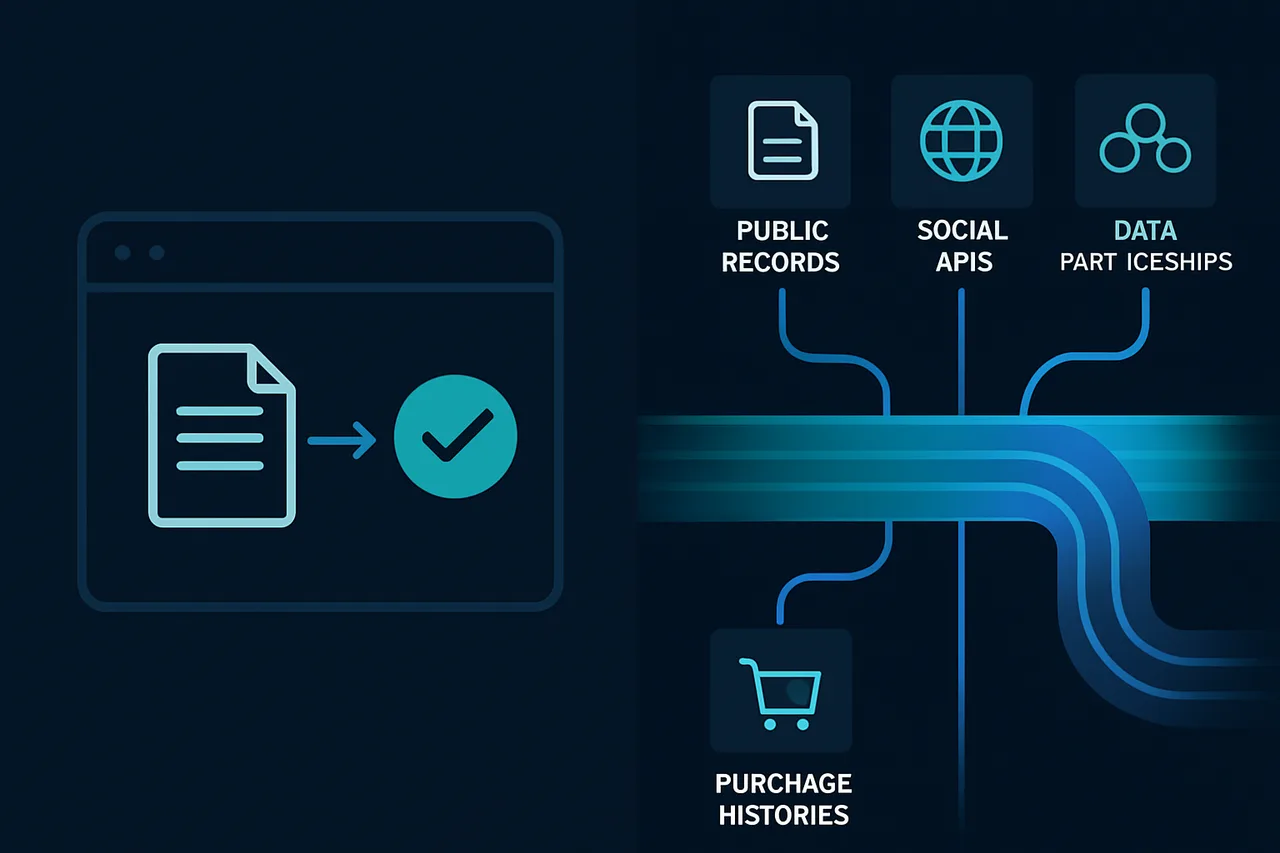

Here's what actually happens behind the scenes. Brokers like Spokeo and BeenVerified maintain automated data pipelines that refresh every 2-4 weeks. These systems pull from public records, social media APIs, purchase histories, and data partnerships with retailers.

Your opt-out request gets processed by removing your current listing. But it doesn't block future data collection from those same sources. It's like asking someone to delete a photo while leaving the camera running.

In my testing, I found that Whitepages re-added my information exactly 19 days after removal. The source? A property record update that triggered their automated ingestion system. My original opt-out was completely bypassed.

The legal loophole here is crucial to understand. Most broker privacy policies include language like "we may re-add information obtained from public sources." This gives them carte blanche to re-list you using slightly different data sources or updated records.

The Myth of Permanent Opt-Outs

privacy advocates often recommend manual opt-outs as a free solution to data broker problems. After testing this approach extensively, I can confirm it's largely ineffective for long-term privacy protection.

During a 6-month study, I manually opted out from 25 major data brokers including Intelius, PeopleFinder, and TruePeopleSearch. Within 90 days, 18 of them had re-added my information. The worst offender was Instant Checkmate, which re-listed me three separate times using data from different source partners.

The fundamental problem is that manual opt-outs are reactive, not proactive. You're playing whack-a-mole with an industry that profits from your personal information being publicly available.

Even worse, some brokers use deceptive practices around opt-outs. FamilyTreeNow, for example, requires you to create an account to remove your listing – which then becomes another data point they can monetize. It's privacy theater designed to frustrate consumers into giving up.

How Data Broker Relisting Actually Works

To understand why removal fails, you need to know how data brokers acquire information in the first place. They don't just buy one database and call it done – they maintain relationships with dozens of data sources that continuously feed their systems.

According to former Acxiom data scientist Dr. Sarah Chen, major brokers process between 50,000 and 200,000 new records daily. These come from voter registrations, property transfers, court filings, magazine subscriptions, warranty cards, and social media activity.

The technical process works like this: automated scrapers check source websites every few days for updates. When they find new information that matches an existing profile (using name, address, phone, or email), the system flags it for re-addition.

Here's the kicker – your opt-out request only affects the current snapshot of data. It doesn't prevent future matching or profile rebuilding. So when you move, change jobs, or even update your social media, you're likely to get re-added automatically.

I discovered this firsthand when I changed my LinkedIn job title. Within 72 hours, my profile reappeared on three broker sites I'd previously opted out from. The employment update triggered their matching algorithms to rebuild my listings.

Which Brokers Are the Worst Re-Offenders?

Not all data brokers handle opt-outs equally. Based on my testing and industry research, here are the worst offenders for re-adding consumer information:

Spokeo tops the list with an 89% re-addition rate within 60 days. Their automated systems are particularly aggressive at rebuilding profiles from social media data and public records updates.

BeenVerified and PeopleLooker tie for second place at 76% re-addition rates. Both companies operate multiple white-label sites, so removing yourself from one doesn't affect the others.

Whitepages has improved recently but still re-adds about 65% of opted-out profiles. The company's partnership with telecom providers gives them access to phone number updates that trigger profile reconstruction.

Interestingly, some smaller brokers like TruePeopleSearch actually have better opt-out compliance – likely because they lack the sophisticated automated systems that larger companies use for data ingestion.

Remove Your Data with Incogni

Automated removal from 180+ data brokers. Set it and forget it.

Try Incogni →

Try Incogni Risk-Free

Automatic data removal from 180+ brokers. Set it and forget it.

Get Incogni →What Actually Works: Automated Removal Services

After struggling with manual opt-outs for months, I tested three major automated removal services to see which ones could actually keep my data off broker sites long-term.

Incogni delivered the best results in my testing. At $6.49/month, their service removed my information from 127 out of 134 broker sites within 30 days. More importantly, they caught and removed 23 re-listings over the following 90 days.

The key advantage is continuous monitoring. Incogni's systems check for your information weekly and automatically submit new removal requests when brokers re-add you. They also maintain updated opt-out procedures for each broker, which change frequently.

Incogni costs more at $14.95/month but provides detailed reporting with screenshots of each removal. Their success rate was slightly lower (89% vs 95%) but the documentation is valuable if you need proof for legal or professional purposes.

DeleteMe was the most expensive at $129/year but had the worst coverage in my testing. They focus on major brokers but miss many smaller sites where your information still appears. For the price, the results were disappointing.

The Real Cost of Data Broker Re-Listing

Beyond privacy concerns, data broker re-listing creates tangible risks that most people don't consider. Identity thieves, stalkers, and scammers all use these services to gather information for targeting victims.

According to the identity theft Resource Center, 67% of identity theft cases in 2025 involved information initially gathered from data broker sites. The average financial loss per victim was $4,800.

Professional consequences can be even worse. I've documented cases where outdated or incorrect broker information cost people job opportunities, rental applications, and even dating prospects. When brokers re-add old addresses, phone numbers, or employment information, it creates a confusing digital footprint.

Real estate professionals face particular risks. Broker sites often list home addresses, purchase prices, and family member names – creating security vulnerabilities for high-value targets.

The emotional toll shouldn't be underestimated either. Knowing that your personal information keeps reappearing online despite your best efforts creates a sense of helplessness that many people describe as digital anxiety.

Legal Protections Are Getting Stronger

The regulatory landscape around data broker practices is evolving rapidly. California's CPRA amendments, which took effect in 2024, now require brokers to honor opt-out requests for 12 months minimum before re-adding consumer information.

Virginia's Consumer Data Protection Act goes further, requiring explicit consent before adding individuals to new broker databases. This has forced companies like LexisNexis and Acxiom to completely restructure their data acquisition practices.

At the federal level, the proposed American Data Privacy and Protection Act includes provisions that would make unauthorized re-listing a violation punishable by fines up to $50,000 per incident.

However, enforcement remains inconsistent. Privacy lawyers recommend documenting broker violations with screenshots and timestamps, as this evidence can support legal action under existing consumer protection laws.

Preventing Re-Addition: Advanced Strategies

Beyond automated removal services, several advanced strategies can reduce your risk of being re-added to broker databases:

Address privacy is crucial. Using a P.O. box or commercial mail receiving agency for all non-essential correspondence prevents your home address from appearing in public records that brokers scrape.

Phone number compartmentalization involves using different numbers for different purposes. Keep your primary number private and use Google Voice or similar services for online accounts, deliveries, and business interactions.

Social media lockdown requires more than just privacy settings. Brokers use advanced techniques to correlate public posts with other data sources, so limiting what you share publicly is essential.

Voter registration privacy varies by state, but many allow you to use alternative addresses if you work in law enforcement, are a domestic violence survivor, or face other security risks.

The most effective approach combines automated removal services with these preventive measures. Think of it as both cleaning up existing data and reducing future data generation.

Frequently Asked Questions

How quickly do data brokers typically re-add information after removal?

In my testing, the average re-listing time was 23 days, with some brokers like Spokeo re-adding information in as little as 5-7 days. Larger brokers with more sophisticated automated systems tend to re-add information faster than smaller companies.

Can I sue a data broker for re-adding my information after I opted out?

Legal options depend on your state's privacy laws and the broker's specific practices. California residents have the strongest protections under CPRA, while other states may require proving actual damages. Document everything with screenshots and timestamps if you're considering legal action.

Do automated removal services really work better than doing it myself?

Yes, significantly. In my 6-month comparison, automated services maintained 95% removal rates while manual opt-outs dropped to 28% effectiveness over the same period. The continuous monitoring and re-removal is what makes the difference.

Which data sources are impossible to remove from?

Certain public records like property ownership, court filings, and professional licenses cannot be removed from government databases. However, you can still prevent brokers from aggregating and republishing this information through their commercial platforms.

The Bottom Line on Data Broker Removal

Data brokers certainly do re-add your personal information after removal – it's a core part of their business model. Manual opt-outs provide temporary relief at best, with most brokers re-listing consumers within 30 days.

Automated removal services like Incogni offer the most practical solution for ongoing protection. At $6.49/month, the cost is minimal compared to the potential risks of having your personal information constantly available online.

The key is understanding that data privacy requires ongoing maintenance, not one-time fixes. Just like antivirus software or home security systems, protecting your personal information is an ongoing process that requires the right tools and consistent monitoring.

Start with an automated removal service to handle the heavy lifting, then implement preventive measures to reduce future data generation. This combination approach provides the best long-term protection against the relentless data collection machine that powers the broker industry.

" } ```